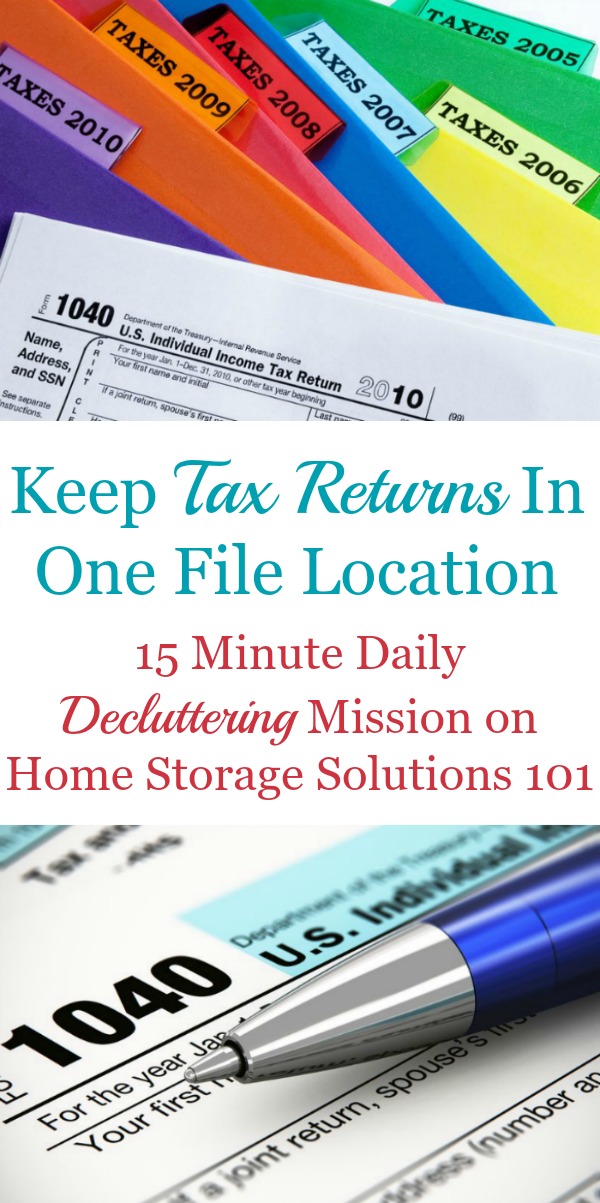

Keep Tax Records In One Filing Location {Plus When To Discard Old Returns}

Today's mission is to keep tax records in one filing location, plus to declutter extremely old tax returns that you don't need to keep anymore.

This mission is designed to be done while working on the Organizing Receipts & Tax Documents Challenge here on the site, which is one of the 52 Week Organized Home Challenges.

Step 1: Gather All Tax Records From Previous Years Into One Place For Filing

It's also a quite simple mission. Every year you file your tax return with the government, and then keep a copy for yourself, along with all the backup documentation necessary to prove the amounts listed in your tax documents, if necessary.The first step of the process is to gather up all these filed tax returns and back up documents into one location, and get them filed in your home filing system.

I suggest you keep one file for each year, perhaps with subfiles if necessary, if you had to file multiple returns (such as a personal return, partnership or other business return, etc.).

The reason for this is that you don't want some years of taxes in one location, and others in another, but instead for everything to be all together in one place. That makes it easier on you, if you ever need to reference these papers again, to find them easily.

Step 2: Declutter Old Tax Returns

The second part of this mission is also simple, which is to declutter (by shredding) any old tax returns that you don't need to keep anymore, so you can get rid of the paper clutter.You can do this annually, as part of the annual decluttering of your file cabinet that I suggest you do, to keep papers from overcrowding your home filing system.

It's a very common question for people to ask -- "how long should I keep tax records and returns?"

The answer, since the government is involved, is, of course, not that simple.

However, I've attempted to answer that question with both the general rules as well as the exceptions to those rules in my article all about how long to keep various types

Before doing the second step of this mission I highly encourage you to read that article so you don't discard anything that you are legally required to keep, or that would be extremely helpful to you to keep if you ever get audited.

I will also say that while I love getting rid of paper clutter the cautious part of me says to really assess how much space you've got for filing papers when doing this mission. If you have more than enough room in your file box or filing cabinet it may be helpful to you to just keep these documents for peace of mind.

Another possibility is to scan and digitize the records so they don't take up physical space anymore, but you can still get copies of them if needed in the future. (Obviously you'll need to keep the digital files in a secure location to keep the information away from hackers or identity thieves, and keep backups so the information is not lost.)

Finally, the main part of the tax paperwork that takes up the most room is the back up tax documentation, like all those receipts, etc. that you keep to prove the amounts you claimed on various lines of your tax return. Typically the copy of the return itself is just a few sheets of paper, and small in comparison. You could also just keep the tax return itself, and get rid of the bulky back up documentation for years that are past the requirements for keeping everything (which is typically 7 years after filing).

To get you inspired to do this simple mission I've shown you an example, below, of how one reader organized her old returns within her files. I'd love to see your results too, once you've done the mission so make sure to submit your photos here and I'll add the best ones to the site!

Join in and write your own page! It's easy to do. How? Simply click here to return to bill clutter.

How To Organize Old Tax Returns & Records In Your Home Filing System

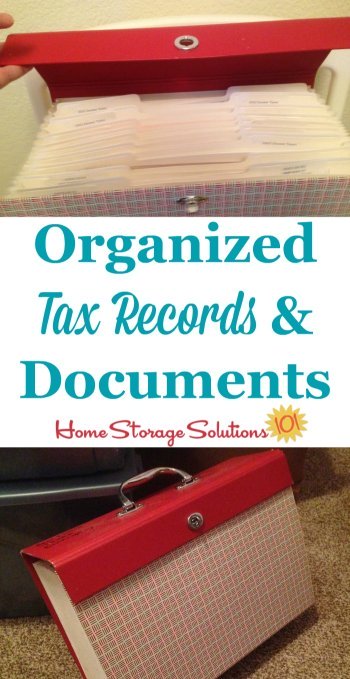

I explained above how to organize your old tax returns and records in your home filing system, but sometimes a picture is worth a thousand words, so here's a photo of it in action from a reader, Elisabeth.

She said, "We use manila envelopes to sort each year. As papers/receipts come in for the year, they are put into the folder and are ready for entering. We prefer this to the open folders because the little stubs and such are contained."

You can definitely contain everything in manila envelopes to contain all the back up paperwork, as well as the returns themselves, to make it even easier on yourself as you're filing these old returns away for later reference if needed. Great job Elisabeth!

Here are some additional photos sent in by readers who've also done this mission.

The photo below is from a reader, Janice, who said, "I’m not worried about the IRS auditing me, but I have saved all of my tax records going back to 1975. I like looking back at the progression of my working life."

If you've got your file cabinet cleared out of excess paper clutter then you might have room for more years of tax returns, if you feel like you'd like to keep them, like Janice did. So great job Janice!

In addition, here's a set of photos from another reader, Samantha, showing her system for filing and organizing old returns and tax paperwork.

Samantha said, "I have a cool looking, plaid, legal size accordion file that I keep the legal documents in. I put the completed taxes in there. I scan tax documents and receipts for taxes as I get them and put them in a folder on the laptop. Hard copies go in the accordion file for the next time I do taxes."

Want To Do More Decluttering Missions? Get Started With Declutter 365 Today!

Once you declutter one type of item in your home I bet you'll want to declutter some more. After all, decluttering gives you a great reward for even a small investment of time and energy.

The Declutter 365 system is designed to help you declutter, over the course of a year, your entire house, with just 15 minutes of decluttering each day!

Hundreds of thousands of people use this proven system to get rid of their clutter, and bring peace and calm back to their homes.

Declutter 365 works to guide you to clear the clutter without overwhelm, focusing on just one small area at a time, and without making a huge mess in the process, so you see consistent forward progress without all that "messy middle" that makes it even harder to function in your home than before you started.

In addition to building a daily decluttering habit, the Declutter 365 program, along with the accompanying 52 Week Organized Home Challenge, teaches you the skills, habits, routines, and mindsets necessary to maintain the clutter free and organized state of your home from now on, so it'll never be as messy and cluttered as it is right now, ever again.

If you haven't already, make sure to get your copy of the 2026 Declutter 365 annual calendar here, find today's date, and do 15 minutes of decluttering on the day's mission. Then, repeat again tomorrow, and again and again. Over the course of the next year, if you do this 15 minutes per day, you'll declutter your whole house!

I understand that some people cannot or don't want to purchase the entire calendar, and so I've also committed to giving away the calendar for free, released month by month.

All those who subscribe to the free newsletter will be notified monthly, as the latest monthly calendar is released on the site, so they can get their free copy.

Get This Bills & Financial Decluttering Checklist + 32 Other Decluttering Checklists For Your Home

Right now you're decluttering papers and other items dealing with your bills and financials, and there's a lot of these types of items around your home.

I've done the hard work of breaking down these tasks into smaller more manageable steps for you, so you don't get overwhelmed or worry you're forgetting a task, and you can go at the pace you want, whether that's fast or slow.

In addition, you can tackle these decluttering tasks in whatever order you want when you use these checklists!

Related Pages You May Enjoy

Getting Clutter Free 15 Minutes At A Time Hall Of FameGetting Rid Of Paper Clutter Hall Of Fame

Removing Bill Clutter Hall Of Fame

Go From Keep Tax Records In One Filing Location Mission To Home Page

Comments for How To Organize Old Tax Returns & Records In Your Home Filing System

|

||

|

||

|

||

|

Click here to add your own comments Join in and write your own page! It's easy to do. How? Simply click here to return to bill clutter. |